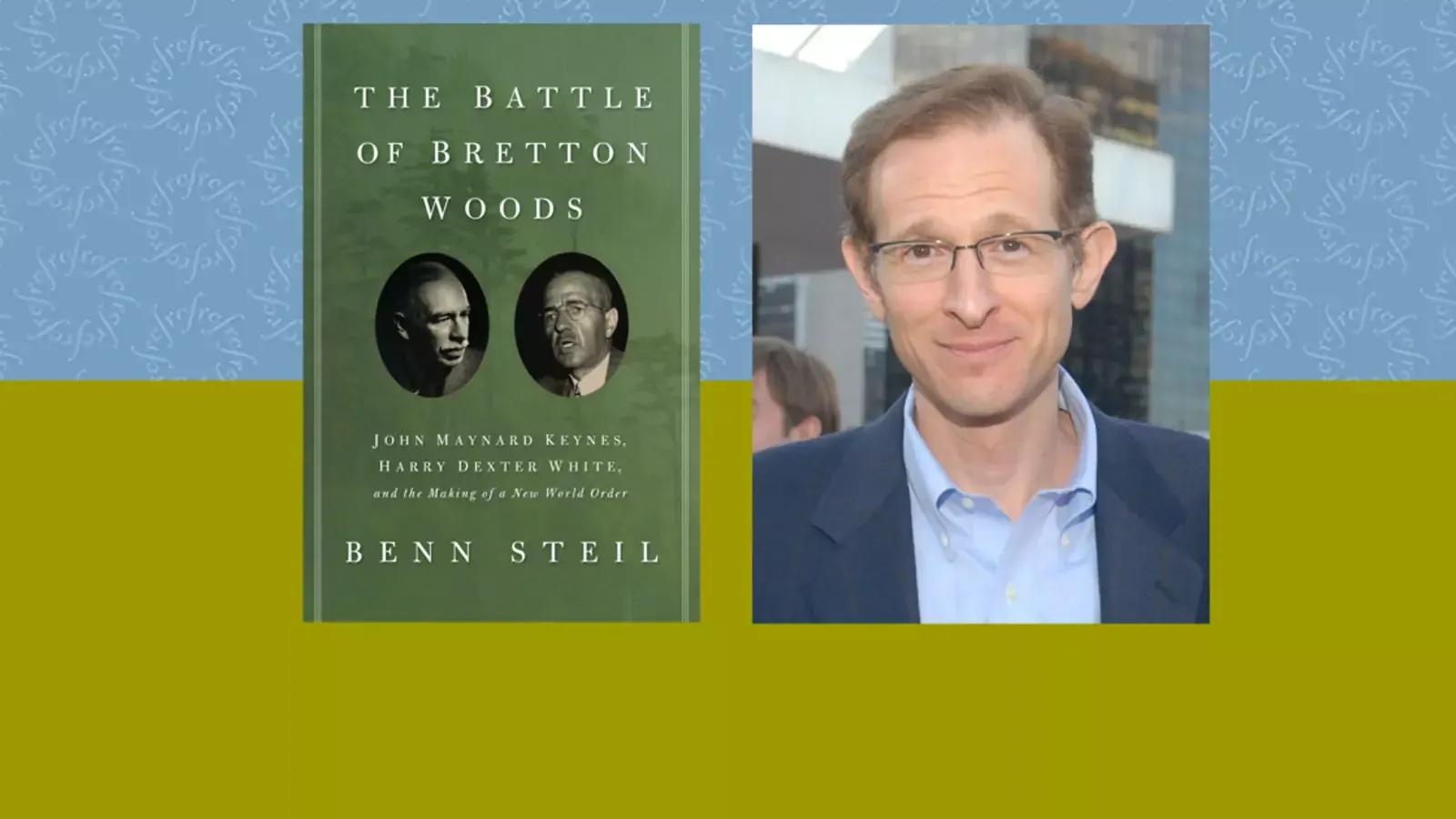

The Battle of Bretton Woods

Introduction

In this book, CFR Senior Fellow Benn Steil challenges the notion that Bretton Woods was the product of an amiable Anglo-American collaboration, and explains that it was in reality part of a much more ambitious geopolitical agenda aimed at eliminating Great Britain as an economic and political rival. Teaching notes by the author.

Summary

When turmoil strikes world monetary and financial markets, leaders invariably call for "a new Bretton Woods" to prevent catastrophic economic disorder and defuse political conflict. The name of the remote New Hampshire town where representatives of forty-four nations gathered in July 1944, in the midst of the century's second great war, has become shorthand for enlightened globalization. The actual story surrounding the historic Bretton Woods accords, however, is full of drama, intrigue, and rivalry—the result of a clash between two different economic visions brought to the fore by rival national interests and personalities. In The Battle of Bretton Woods: John Maynard Keynes, Harry Dexter White, and the Making of a New World Order, Benn Steil upends the conventional wisdom that Bretton Woods was the product of an amiable Anglo-American collaboration. Dr. Steil shows that in reality it was part of a much more ambitious geopolitical agenda hatched within President Franklin D. Roosevelt's Treasury that aimed at eliminating Britain as an economic and political rival.

This book offers sophisticated but accessible analysis of alternative monetary and exchange-rate regimes in their historical context, making it a valuable text for undergraduate and graduate courses on international finance and monetary policy, twentieth century economic history, international political economy, and twentieth century U.S. and European history and politics.

Discussion Questions

Courses on Finance and Economics

- Why did the United States champion fixed exchange rates during the 1940s, and why does it advocate flexible exchange rates today? What are the main political and economic factors that brought about this change?

- What would the American and British architects of Bretton Woods think about the way in which exchange rates and international capital flows are permitted to operate today?

- What are the similarities and differences between the U.S.-UK creditor-debtor relationship in the 1940s and the China-U.S. creditor-debtor relationship today?

- According to the original Bretton Woods blueprint, what role was the International Monetary Fund supposed to play in the global economy? How and why was this role different from the role it actually plays today?

- Do we need a "new Bretton Woods"? Is such a thing politically feasible? Why or why not?

Courses on Twentieth Century U.S. and European History and Politics

- What role did international monetary conditions in the 1930s and '40s play in the collapse of the British empire after World War II?

- What lessons does the Bretton Woods saga offer for how U.S.-China relations will evolve?

- How should historians today think about Harry Dexter White's affinity with the Soviet Union in the 1930s and '40s, particularly in regards to his personal interactions with Soviet officials and their secret American conduits?

Essay Questions

Courses on Finance and Economics

- After World War II, there were many prominent critics of the Bretton Woods fixed exchange rate system. Discuss some of the pros and cons of the main alternatives debated in the 1960s and '70s, such as a supranational currency (Robert Triffin), the classical gold standard (Jacques Rueff), floating exchange rates (Milton Friedman), and competing private currencies (Friedrich Hayek).

- Why did the Bretton Woods fixed exchange rate system collapse in the early 1970s? Consider whether the system itself was flawed, or whether it could it have been sustained indefinitely through different national economic policies.

- Why did the gold-exchange standard established after World War I collapse in the early 1930s? What role did President Franklin Roosevelt's Treasury Department believe this collapse played in fueling the Great Depression and creating the conditions that led to World War II? Do you believe this assessment was accurate?

- Was Keynes's idea for a supranational currency a good one? Should the United States support the emergence of such a currency today? Should China?

- Will the U.S. dollar continue indefinitely to be the world's dominant currency for international trade and central bank reserves? Discuss the most likely alternatives.

Courses on Twentieth Century U.S. and European History and Politics

- To what extent did British national interests determine the economics that Keynes advocated at Bretton Woods? To what extent did Keynes's economics color his performance as a diplomat and a representative of British interests?

- Discuss how power and national interests came to define the outcome at Bretton Woods in 1944. What does the Bretton Woods saga teach us about the role of national interest in the making of international economic policy?

- What does the Bretton Woods saga teach us about the role of economics in the making and conduct of foreign policy?

- How and why did the American political and economic thinking underlying the Marshall Plan in 1947 differ from that underlying Bretton Woods in 1944?

- Discuss the importance of economics in the rise of the United States and the fall of Great Britain as global powers after World War I.

Supplementary Materials

Chambers, Whittaker. 1952. Witness. New York: Random House.

Clarke, Peter. 2008. The Last Thousand Days of the British Empire: Churchill, Roosevelt, and the Birth of the Pax Americana. New York: Bloomsbury Press.

Haynes, John Earl, and Harvey Klehr. 1999. Venona: Decoding Soviet Espionage in America. New Haven, CT: Yale University Press.

James, Harold. 1996. International Monetary Cooperation since Bretton Woods. New York: Oxford University Press.

Rueff, Jacques, and Fred Hirsch. 1965. The Role and the Rule of Gold: An Argument. Essays in International Finance, No.47, Princeton, NJ: Princeton University Press.

Skidelsky, Robert. 2000. John Maynard Keynes: Fighting for Britain, 1937-1946. London: Macmillan.

Steil, Benn. "Red White: Why a Founding Father of Postwar Capitalism Spied for the Soviets," Foreign Affairs, March/April 2013.

Steil, Benn. "How Dollar Diplomacy Spelled Doom for the British Empire", Bloomberg Echoes, 6 March 2013.

Steil, Benn. "Why There Will Be No New Bretton Woods", Wall Street Journal, 27 February 2013.

Steil, Benn. "Banker, Tailor, Soldier, Spy", New York Times, 9 April 2012.

Triffin, Robert. 1960. Gold and the Dollar Crisis. New Haven: Yale University Press.

Zhou, Xiaochuan. Mar. 23, 2009. Statement on Reforming the International Monetary System. Available at http://www.cfr.org/china/zhou-xiaochuans-statement-reforming-international-monetary-system/p18916.