What Is a Carbon Border Adjustment Mechanism?

Learn how governments can prevent international carbon leakage from their climate mitigation policies.

Imagine a game of Whac-a-Mole. Whenever you slam the hammer down on one mechanical mole, another pops up out of a different hole. That is what mitigation policy can seem like to some countries.

One country could establish a carbon tax or other policy that reduces greenhouse gas emissions within its borders. However, that policy could just shift the emissions to another country. The first country will have swung the hammer down on local emissions simply to see them pop up somewhere else. To stop climate change, though, the world’s total emissions need to come down.

So, how can countries reduce emissions at home without causing them elsewhere?

One tool is a carbon border adjustment mechanism, or CBAM. It’s a measure that aims to apply the impact of domestic mitigation policies onto products made abroad. That strategy helps prevent businesses from moving their pollution activities to countries with weaker climate rules. That way, the domestic mitigation policies don’t just lower carbon emissions locally, but instead help decrease them worldwide.

CBAMs make the global economy greener, but critics argue that they hurt domestic businesses and limit free trade.

This resource explores how CBAMs work, where they exist today, and the concerns raised by critics of the policy.

How does a CBAM work?

A CBAM complements a country’s other efforts to reduce carbon emissions. Those efforts typically increase the cost of carbon-emissions activities within the country, so domestic businesses that rely on those activities will look for cheaper options abroad.

Let’s consider an example: you run a car company. You need steel to make your cars, but since the government introduced the cap-and-trade system, you need to pay more to produce the same amount of steel. Then, you have an idea: What if you import steel from a different country that does not have costly carbon-pricing regulations? You could save money—and potentially increase your profits—by avoiding the cost of carbon emissions and importing steel from overseas.

But think about what will happen to the total amount of global emissions. If you import the same quantity of steel from overseas, then the carbon emissions in your country will decrease. However, the carbon emissions in the steel-producing country will increase. In that example, the total amount of carbon emitted globally stays about the same. Such situations—when carbon emissions decrease in one country but increase in another—is called carbon leakage.

Carbon leakage

Carbon leakage can undermine a country’s climate mitigation goals and cause more carbon emissions overseas. That’s where the CBAM comes in. Under a CBAM, companies need to pay for the cost of carbon even if it is emitted overseas. Think back to your car company. Under the cap-and-trade scheme, you could avoid paying for your emissions by importing carbon-intensive steel from abroad. But with the CBAM, you have to pay the difference between the emissions cost of foreign and domestic steel.

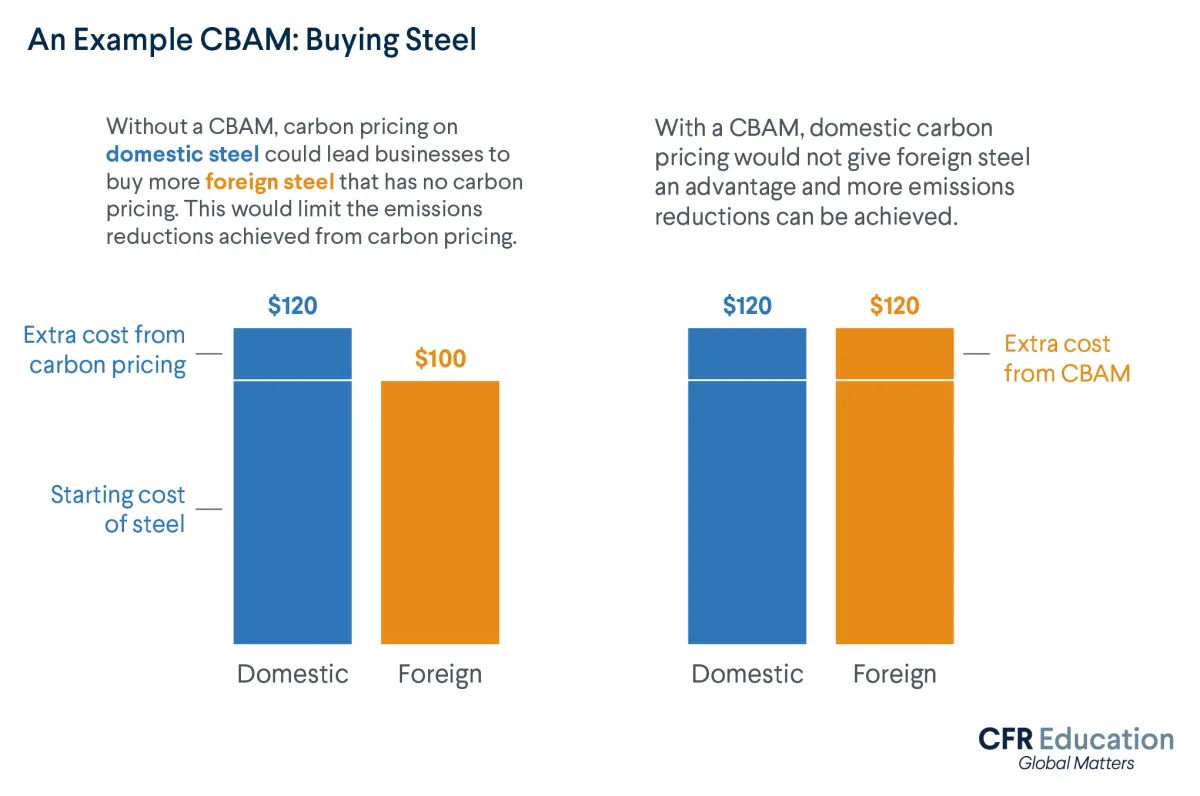

Imagine this scenario: Steel produced abroad—in a country with no carbon-pricing policy—costs $100 per unit. Steel produced at home would also cost $100 per unit if it weren’t for a cap-and-trade policy. The policy makes businesses bear the cost of carbon in a way that adds $20 per unit to the price of steel. So, steel produced at home costs $120 per unit. Without a CBAM, a domestic business can import foreign steel and save $20 per unit. But under a CBAM, if a business wants to import foreign steel, it must purchase carbon certificates amounting to the difference between the foreign and domestic costs of carbon—in this case, $20 per unit. (In this example, both countries’ steel-production processes emit the same amount of carbon per unit.)

But what if the other country does have some carbon-pricing policies in place? If a foreign producer in that country can demonstrate that they have already paid a price for the carbon used in their goods, then domestic importers can deduct the corresponding cost when they purchase carbon-intensive goods from overseas. Let’s say, in the earlier example, the foreign country adopted a policy that increased the cost of carbon a bit—adding $5 per unit to the cost of the foreign steel. If domestic businesses wanted to import that foreign steel, they’d have to purchase carbon certificates costing $15 per unit. That’s the difference between the domestic carbon costs ($20 per unit) and the foreign carbon costs ($5 per unit).

The CBAM adjusts the price of foreign goods so that they bear the same carbon emission costs as goods produced at home. That protects domestic producers from being undercut by foreign producers in countries with weaker climate rules. In turn, it encourages those foreign countries to strengthen their climate rules. If they were to also adopt carbon prices or reduce the emissions of the goods they produced, then importers of those goods in countries with CBAMs would pay less for the carbon certificates. Thus, carbon leakage is limited in countries with the CBAMs, and businesses in other parts of the world are encouraged to reduce their emissions.

Do any countries have CBAMs today?

The European Union (EU) is currently introducing a CBAM.

Since 2005, the supranational organization has had a cap-and-trade system. That system created a cost for CO2 emissions from carbon-intensive production facilities. However, policymakers worried that certain industries, like cement and steel manufacturing, were particularly vulnerable to carbon leakage. If they had to bear the full carbon cost, then production would likely shift outside the EU. To help address that concern, the EU gave those industries “free allowances,” letting them avoid paying for most of their emissions. Although this prevented carbon leakage, it weakened the emissions-reducing effect of the EU’s cap-and-trade system.

Now, the EU is slowly starting to phase out those free allowances, while phasing in a CBAM. EU importers of cement, steel, and certain other carbon-intense products will be required to purchase certificates under the CBAM. The cost of those certificates will correspond to the carbon price that would have been paid if the products had been produced in the EU. The CBAM should protect against carbon leakage as those carbon-intensive industries start paying for their emissions.

Internationally, no other CBAM has been established. The United Kingdom is planning to adopt one in the next few years, and Australia, Canada, and Turkey are also exploring potential CBAM policies.

In the United States, both Democratic and Republican senators have proposed frameworks similar to a CBAM. Those proposals include the Foreign Pollution Fee Act and the Clean Competition Act, but none have been enacted yet. On a smaller scale, the state of California has a limited carbon border adjustment mechanism. It specifically targets electricity that’s imported from other states.

What are potential issues with CBAMs?

Reducing carbon leakage can help mitigate climate change. So why do some countries oppose CBAMs? Let’s consider the implications of the EU’s CBAM for various groups.

Large foreign producers: Countries like Australia, China, and India have criticized the EU’s CBAM. They argue it serves as a protectionist measure that interferes with free trade. Those countries export carbon-intensive goods to the EU. They believe that the CBAM will both increase the price of their goods and reduce their exports to the EU.

Less developed countries: Some critics argue that the EU’s CBAM will reduce trade levels and gross domestic product (GDP) in less developed countries. Mozambique, for instance, exports 97 percent of its aluminum to the EU. Since the CBAM will effectively increase the price of aluminum and other goods for EU importers, it could reduce imports and negatively affect the economies of countries without stringent carbon-pricing schemes.

Moreover, others are skeptical that the EU’s CBAM complies with the rules of the World Trade Organization (WTO). Even if it does, powerful foreign countries could still retaliate against the EU measure. In 2012, when the EU attempted to introduce a CBAM for the aviation sector, an international political backlash (from the United States, Brazil, China, India, Japan, Korea, Mexico, Nigeria, and Russia) led to the policy’s withdrawal.

Some advocates of robust climate mitigation policies criticize the EU’s CBAM as too limited in scope. Remember the car company example? Under the CBAM, you will have to pay the EU’s carbon price for the steel you import from abroad. But what if you could avoid importing raw steel altogether? Instead, you could import the car body, which is made of steel but not covered by the CBAM. Your car company would avoid paying for the carbon price and weaken the emissions-reducing effect of your government’s mitigation policy.

While it’s difficult to close all the loopholes, CBAMs are still likely to reduce carbon leakage.

When it comes to designing climate change mitigation policies, countries face hard choices. Strong mitigation policies can put domestic businesses at a competitive disadvantage and shift emissions abroad. CBAMs, however imperfect, can help counter that shift, pushing other countries to factor in the environmental cost of carbon. So even if policymakers are still playing Whac-a-Mole(cule) with CO2, CBAMs at least give them another hammer.