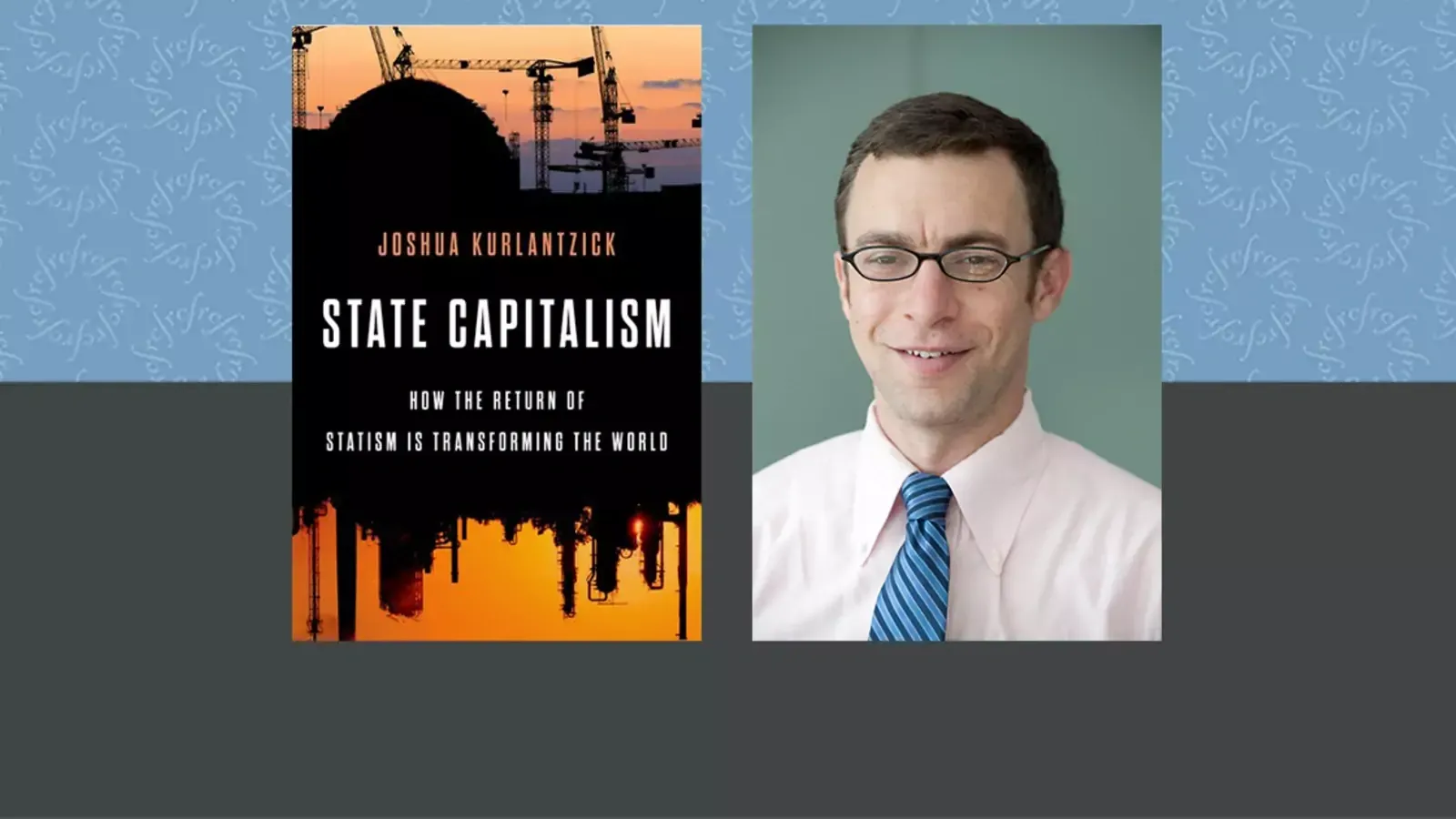

State Capitalism: How the Return of Statism is Transforming the World

Introduction

In his new book, State Capitalism: How the Return of Statism is Transforming the World, Council on Foreign Relations Senior Fellow for Southeast Asia Joshua Kurlantzick analyzes the rise in state capitalism in developing nations, including China, Russia, Singapore, Thailand, Malaysia, Indonesia, Brazil, and South Africa, among other states. He defines state capitalism as situations in which governments control or exert significant influence over at least one-third of the largest corporations in a country.

Summary

Over the past two decades, many developing countries have turned away from free market capitalism and toward modern state capitalism, which is a combination of traditional state economic planning and elements of free market competition, including openness to free trade and foreign investment. In some ways, the new state capitalists have copied strategies of the high-growth Asian economies during the Cold War, which mixed central planning and export-led growth, but many of the new state capitalists are even more open to trade and investment. In his new book, State Capitalism: How the Return of Statism is Transforming the World, Council on Foreign Relations Senior Fellow for Southeast Asia Joshua Kurlantzick analyzes the rise in state capitalism in developing nations, including China, Russia, Singapore, Thailand, Malaysia, Indonesia, Brazil, and South Africa, among other states. He defines state capitalism as situations in which governments control or exert significant influence over at least one-third of the largest corporations in a country.

In the book, Kurlantzick examines several brands of state capitalism in detail, and offers insights about the potentially positive and negative implications for international relations and the international economy of increasing state control of companies in these countries.

Singapore, China, and Vietnam, have at times used government control of companies to support nascent industries and spark innovation. Democratic state capitalists, such as Brazil, India, and Indonesia, appear capable of balancing economic statism with political freedom. However, in less democratic countries like Thailand, Turkey, and Malaysia, state capitalism’s erosion of political freedom may lead to political instability. In young democracies such as Thailand and Malaysia, state capitalism could potentially put too much power in the hands of a few leaders and help corrode democratic culture and institutions. In countries like Russia, where economic weaknesses are exacerbated by state capitalism, an economic collapse could shock the entire global economy.

In the book, Kurlantzick encourages the United States and other leading democracies to look beyond the level of state control of economies, to the type of political system in place. He notes that democratic state capitalists are not necessarily a threat and may even be effective partners for the United States. He urges policymakers to concentrate on democracy promotion and civil society in strategically important nations with weak democracies that are beginning to embrace state capitalism.

This book is suitable for undergraduate courses on:

- International Relations

- International Economics

- Comparative Politics

- Comparative Economics

- East Asian Politics

Discussion Questions

Courses on International Relations and International Economics:

- What differences, if any, can one see between how the United States and other wealthy democracies interact in international organizations, and how democracies and authoritarian states interact in international organizations?

- What lessons can be drawn from the impact of the 2008–2009 financial crisis on the ability of the United States and other democracies to promote rights and democracy worldwide? How much, if at all, does growing isolationist sentiment in wealthy democracies affect the ability of democratic leaders to promote rights and freedoms abroad?

- What are some of the reasons for the rise of elected autocrats in developing nations? How much of a role does statist economics play in the rise of elected autocrats? Is the trend of elected autocrats going to spread to wealthy, established democracies in North America, Asia, and Europe?

- What would be an example of countries using state companies as weapons in international disputes? How might other nations respond? How should multinational corporations respond, if at all?

- What measures might the United States use to assess the potential dangers of state capitalism to a given country’s growth and development, and how should U.S. policymakers assess which foreign economies are “too big to fail”—i.e, should get an international bailout if they fall into dangerous recessions?

- How, if at all, should multinational companies revamp their outward investment strategies in countries where state capitalism is on the ascendance? What are their advantages as compared to state companies, and disadvantages?

- What are the most efficient uses of state funds in developing nations with shallow capital markets? Should governments use state monies to support nascent industries in developing nations? Are there conflicts for governments today in accomplishing such a task and also joining a growing network of regional and bilateral free trade agreements?

Courses on Comparative Politics and Comparative Economics:

- Compare and contrast the development and political transitions of Indonesia and Thailand, two neighboring nations with relatively similar income levels. What factors account for their different political and economic trajectories?

- What are the prospects for successful democratic transition in Myanmar, which held its first successful national election in five decades in November 2015? What factors, including state control of parts of the economy, could propel or hinder Myanmar’s democratic transition?

- What lessons can be drawn from Norway’s ability to develop large, state owned enterprises that are relatively transparent and efficient? How much, if at all, can the “Norway model” be adapted to less prosperous nations, especially those with significant natural resources?

- What lessons can be drawn from Singapore’s use of state funds to support nascent industries in sectors of the economy where there were shallow private capital markets? How much, if at all, could this “Singapore model” of development be applied to other developing nations?

- What regions of the world have avoided the broader “democracy regression” of the past decade? Why have they been able to avoid it, and what role does their economic policy-making play in their continued democratic transitions?

Essay Questions

Courses on International Relations and International Economics:

- If the next U.S. administration wanted to focus U.S. foreign assistance on promoting democracy and also on promoting effective economic governance, how should it reform U.S. aid practices? Which countries should it focus U.S. foreign assistance efforts on?

- How should U.S. policymakers decide when actions taken by China, including China’s use of state companies, constitute a real threat to U.S. strategic and economic interests? How should U.S. policymakers determine when Chinese actions are not a threat to U.S. strategic and economic interests?

- What criteria should policymakers use to determine whether state companies are being utilized as weapons? What types of deterrence and/or responses should policymakers envision when state companies are used as weapons?

Courses on Comparative Politics:

- What lessons can be drawn from Indonesia’s example of political transition and applied to other developing nations in Asia? Pick specific lessons from the Indonesian experience and assess their applicability to the economic and political reform processes in other developing Asian countries.

- What lessons can be drawn from the countries that went through the third wave of democratic transition—between 1974 and the mid-2000s—for countries that are facing democratic regression today? Offer some insights as to how countries that are currently regressing politically could return to democratic transitions. What role do growth and development play in restoring democratic transitions?

Supplementary Materials

Courses on International Economics:

Anderson, Chris, The Long Tail: Why the Future of Business is Selling Less of More (New York: Hyperion, 2006).

Anderson, Jonathan, “Beijing’s Exceptionalism,” The National Interest, March/April 2009, p. 23.

Araujo, Heribierto and Cardenal, Juan Pablo, China’s Silent Army: The Pioneers, Traders, Fixers and Workers Who Are Remaking the World in Beijing’s Image (New York: Crown, 2013).

Economy, Elizabeth and Levi, Michael, By All Means Necessary: How China’s Resource Quest is Changing the World (New York: Oxford University Press, 2014).

Forsythe, Michael and Sanderson, Henry, China’s Superbank: Debt, Oil and Influence—How China Development Bank is Rewriting the Rules of Finance (New York: Bloomberg Press, 2013).

Fang Feng, Qian Sun, and Wilson H.S. Tong, “Do Government-Linked Companies Underperform?” Journal of Banking and Finance, no.28, 2004, pp. 2461-2492.

“Gazprom: Russia’s Wounded Giant,” The Economist, March 23, 2013, p. 59.

Ghesquiere, Henri, Singapore’s Success: Engineering Economic Growth (Singapore: Thomson Learning Press, 2007).

Kurlantzick, Joshua, “Rise of the False Reformers,” Bloomberg Businessweek, September 4, 2014.

Lazzarini, Sergio G. and Musacchio, Aldo, Reinventing State Capitalism: Leviathan in Business, Brazil, and Beyond (Cambridge: Harvard University Press, 2014).

Mallet, Victor, “India Launches Chinese-Style Economic Revival Plan,” Financial Times, June 9, 2014.

Magnus, George, “The Chinese Model is Nearing its End,” Financial Times, 21 August 21, 2015.

Mattlin, Mikael, “The Chinese Government’s New Approach to Ownership and Financial Control of Strategic State-Owned Enterprises,” Bank of Finland Discussion Paper, June 19, 2007.

Miller, Terry and Riley, Bryan, 2016 Index of Economic Freedom, Heritage Foundation.

Pack, Howard and Saggi, Kamal, “Is There a Case for Industrial Policy? A Critical Survey” World Bank Research Observer, Fall 2006, pp. 290-292.

Robinson, Neil ed, The Political Economy of Russia (Lanham, MD: Rowman and Littlefield, 2013).

Rodrik, Dani, “Goodbye Washington Consensus, Hello Washington Confusion? A Review of the World Bank’s Economic Growth in the 1990s: Learning from a Decade of Reform,” Journal of Economic Literature, 44(4), 2006, pp. 973-975.

Romero, Simon, “As Growth Ebbs, Brazil Powers Up its Bulldozers,” New York Times, June 21, 2012.

Schapiro, Mario, “Rediscovering the Developmental Path? Development Bank, Law, and Innovation Financing in the Brazilian Economy,” Sao Paolo Law School Working Paper, January 2012.

“The Rise of State Capitalism,” The Economist, January 21, 2012.

Tsai, Kellee, Capitalism without Democracy: The Private Sector in Contemporary China (Ithaca, NY: Cornell University Press, 2007.

Vaitheeswaran, Vijay, “Back to Business,” The Economist Special Report, September 12, 2015.

Courses on International Relations:

Anderlini, Jamal, “How Long can the Communist Party Survive in China?” Financial Times, September 20, 2013, p. A7.

“Chasing the Chinese Dream,” The Economist, May 4, 2013.

Diamond, Larry, “Facing up to the Democratic Recession,” Journal of Democracy, January 2015, pp. 141-155.

Diamond, Larry, Plattner, Mark, and Walker, Chris, eds., Authoritarianism goes Global: The Challenge to Democracy (Baltimore: Johns Hopkins University Press, 2016).

Dore, Giovanna Maria, Jackson, Karl, and Ku, Jae eds, Incomplete Democracies in the Asia-Pacific: Evidence from Indonesia, Korea, the Philippines and Thailand (New York: Palgrave Macmillan, 2014).

Economy, Elizabeth, “China’s Imperial President,” Foreign Affairs, November/December 2014.

Freedom House, Freedom in the World 2016 (New York: Freedom House, 2016).

Freeman, Charles III and Yuan, Wen Jin, “China’s New Leftists and the China Model Debate after the Financial Crisis,” Center for Strategic and International Studies Freeman Chair in China Studies Report, July 2011.

“Gazprom: Russia’s Wounded Giant,” The Economist, March 23, 2013, p. 59.

Ghesquiere, Henri, Singapore’s Success: Engineering Economic Growth (Singapore: Thomson Learning Press, 2007).

“Global Findings,” Bertelsmann Transformation Index, 2014.

Halperin, Morton, Siegle, Joseph, and Weinstein, Michael, The Democracy Advantage: How Democracies Promote Prosperity and Peace (New York: Routledge/Council on Foreign Relations, 2005).

Kurlantzick, Joshua, Democracy in Retreat: The Revolt of the Middle Class and the Worldwide Decline in Representative Government (New Haven: Yale University Press, 2013).

Lazzarini, Sergio G. and Musacchio, Aldo, Reinventing State Capitalism: Leviathan in Business, Brazil, and Beyond (Cambridge: Harvard University Press, 2014).

Lenco, Jonathan and MacDonald, Scott, State Capitalism’s Uncertain Future, (Santa Barbara, CA: Praeger, 2015).

Lipset, Seymour Martin, “Some Social Requisites of Democracy,” American Political Science Review, 53, no. 1 (1959): pp. 69-105.

MacGregor, James, No Ancient Wisdom, No Followers: The Challenges of Chinese Authoritarian Capitalism (Connecticut: Prospecta Press, 2012).

Mahbubani, Kishore, “The Pacific Way,” Foreign Affairs, January/February 1995.

McCargo, Duncan and Pathmanand, Ukrist, The Thaksinization of Thailand (Copenhagen: Nordic Institute of Asian Studies, 2004).

Mattlin, Mikael, “The Chinese Government’s New Approach to Ownership and Financial Control of Strategic State-Owned Enterprises,” Bank of Finland Discussion Paper, June 19, 2007.

Nathan, Andrew, “China at the Tipping Point? Foreseeing the Unforeseeable,” Journal of Democracy, January 2013.

Nathan, Andrew, “The Puzzle of the Chinese Middle Class,” Journal of Democracy, April 2016, pp. 5-19.

Pei, Minxin “Five Ways China Could Become a Democracy,” The Diplomat, February 13, 2013.

Pei, Minxin, China’s Trapped Transition: The Limits of Developmental Autocracy (Cambridge, MA: Harvard University Press, 2008).

“The Rise of State Capitalism,” The Economist, January 21, 2012.

Vaitheeswaran, Vijay, “Back to Business,” The Economist Special Report, September 12, 2015.

“What’s Gone Wrong with Democracy?” The Economist, May 1, 2014.

Williamson, Ian and Zagha, Roberto, “From the Hindu Rate of Growth to the Hindu Rate of Reform,” Stanford Institute for Economic Policy Research Working Paper 144, July 1, 2012.