The Terrorist Money Trail

How do terrorists get funding? Learn about the challenges of targeting the finances of terrorist groups in this free resource on terrorism.

On September 10, 2001, a man named Mohamed Atta visited an ATM in South Portland, Maine. From security footage, it looked like a routine transaction. But it was hardly ordinary: the money he withdrew had been transferred from accounts run by a senior al-Qaeda operative in the United Arab Emirates. The next morning, Atta steered American Airlines flight 11 into the north tower of the World Trade Center.

Targeting terrorist finance became a priority after the 9/11 attacks. To prevent future attacks, the U.S. government tried to identify moments when it could have stopped al-Qaeda’s plot. If U.S. intelligence agencies monitored the terrorist operatives’ wire transfers, newly opened bank accounts, ATM transactions, car rentals, and ticket purchases, the events on 9/11 could have been prevented.

Following the money

Today, “following the money” remains a major part of U.S. counterterrorism strategy. Terrorists need funds to carry out attacks and maintain their organizations. U.S. officials can frustrate potential attacks by restricting terrorists’ access to cash. They can also learn more about how and where terrorist groups are operating by observing their finances.

To do this, the U.S. government first expanded its own operations. Days after 9/11, President George W. Bush issued Executive Order 13224, which froze all assets in the United States of designated Islamist terrorist groups and associated individuals. As of August 2023, the list of people and groups designated under this executive order has grown to more than 2,200 pages long.

Bush’s executive order also expanded the powers of the treasury secretary to impose sanctions on banks around the world. Reinforced by the Patriot Act, it effectively prevented foreign banks that did not cooperate with American investigators from doing business in the United States or in U.S. dollars. The government also called on the private sector, namely, the big banks that have a global presence. Moving forward, banks were responsible for flagging suspicious transactions and freezing suspected terrorist accounts.

These strategies have achieved some success, both in disrupting financial flows and in using financial intelligence to disrupt attacks. In 2007, for example, a propaganda video showed al-Qaeda’s finance chief asking for money, reminding supporters that “funding is the mainstay of jihad.” Investigators, alerted in part by large transactions disguised as earthquake relief, foiled a 2006 plot to blow up British planes traveling to the United States with liquid explosives. Nonetheless, the fight to bankrupt terrorism faces a number of challenges.

Why is fighting terrorism through money so difficult?

Ideology over money

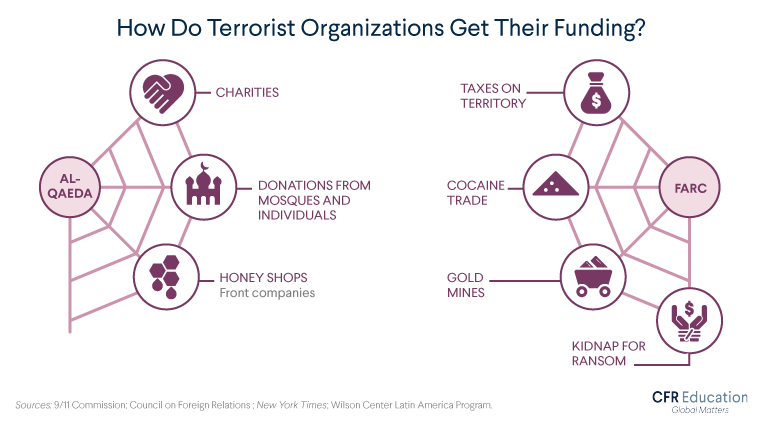

First, ideology—not profit—drives terrorism. Terrorists are flexible when it comes to where they get their money. They usually have multiple funding sources, such as profits from illegal activities, money funneled from charities, and direct donations. The wide range of examples illustrates the extent of the challenge for counterterrorism officials. In the 1980s, a charity called the Irish Northern Aid Committee, or NORAID, had a large presence in New York and Boston. This charity was a major source of overseas funding for the Provisional Irish Republican Army. In addition to receiving donations from people and charities based in Saudi Arabia (including the questionably named organization, Help Africa People), al-Qaeda operated a string of legitimate businesses, including honey shops in Yemen and Pakistan. These businesses enabled al-Qaeda to earn revenue and move money covertly.

Terrorists often tap into local criminal enterprises, using existing networks instead of putting time and resources into creating their own. FARC, for example, profited from Colombia’s cocaine trade because it controlled land used to grow the coca plant. Unlike Colombia’s drug cartels, however, FARC depended on the illegal drug business for just a portion of its revenue stream. FARC diversified its revenues by kidnapping for ransom, mining minerals, extorting energy companies, and taxing gold mines. Terrorist groups such as the Islamic State and Boko Haram also raise funds through human trafficking—one of the world’s most profitable crimes. Today, human trafficking generates $150 billion annually. For terrorist groups, money is simply a means to an end, rather than an end in itself.

In some instances, terrorist groups may work together to raise funds. For example, Somalia-based ISIS members have reportedly collaborated with al-Shabaab and al-Qaeda to raise funds through activities like illegal fishing and black-market smuggling.

Limitations of financial measures

Financial tools also have limits. At the self-declared Islamic State’s height in late 2014, it was reportedly worth $2 billion and often referred to as the world’s wealthiest terrorist organization. A pseudo-state controlling a territory the size of Britain, it exploited what it had: land, resources, and a population of, at one point, 11 million. The group taxed people and businesses at extortionary rates, sold oil below market rate, looted villages as they were conquered, and imposed fines for minor infractions. The Islamic State did not depend heavily on the international financial system; therefore, freezing bank accounts and imposing targeted sanctions had a limited effect on the group. Seizing the Islamic State’s territory, the real source of its wealth, required military, not financial, operations. But military and financial strategies can work in tandem: some coalition military operations targeted the Islamic State’s economic infrastructure. These operations aimed to limit the group’s ability to pay fighters and keep its governance running.

The United States has worked and continues to work with the Syrian Democratic Forces and Iraqi Security Forces to combat the Islamic State insurgency in Syria and Iraq. According to a U.S. Treasury report, despite leadership losses, the Islamic State’s core still has access to as much as $25 million in cash revenues in Iraq and Syria.

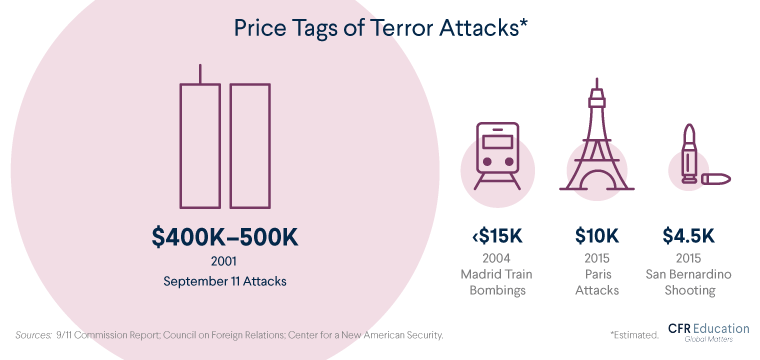

Cheap terrorism

Finally, terrorism can be done on the cheap. Attacks themselves are often inexpensive, a reflection of an evolution in tactics. The elaborate and devastating 9/11 attacks cost close to half a million dollars. As a result, much of the counter-finance infrastructure put in place was designed to look for large transfers of money. But no attacks since then have come close, cost-wise. Even al-Qaeda’s coordinated 2004 Madrid transit bombings—ten bombs exploded simultaneously on four trains, killing nearly two hundred people—cost less than $50,000. Examples, like the 2016 truck attack in Nice, France, suggest that attacks are only getting cheaper. A 2015 study found that the majority of European-based terrorist cells between 1994 and 2013 have been self-funded. Moreover, three-quarters of attacks in Europe have cost less than $10,000 each.

Why do financial measures matter?

Financial measures alone cannot stop terrorism completely, nor can every suspicious transaction be flagged. But most policymakers argue that that is not the point: the goal of interrupting terrorist finance is not to eliminate the threat but to make it harder for groups to operate. Counterterrorism officials need a variety of tools to both undermine the ideological pull of terrorism and prevent terrorists from easily acting on their beliefs. Financial tools represent just one part of a broader strategy to manage an evolving threat.